Health Insurance

Why Health Insurance Premiums Increase: Understanding the Factors

Why Health Insurance Premiums Increase: Understanding the Factors

Health insurance is an essential aspect of our lives, providing financial protection in times of medical emergencies. However, it is not uncommon for individuals to wonder why health insurance premiums increase over time. In this article, we will delve into the various factors that contribute to the rise in health insurance premiums and gain a better understanding of this complex issue.

Factors Influencing Health Insurance Premiums

1. Medical Inflation: One of the primary reasons for the increase in health insurance premiums is medical inflation. The cost of healthcare services, including doctor visits, hospital stays, and prescription medications, tends to rise each year. As a result, insurance companies need to adjust their premiums to cover these escalating costs.

2. Advancements in Medical Technology: The constant advancements in medical technology have undoubtedly improved healthcare outcomes. However, these innovations come at a price. Cutting-edge treatments and state-of-the-art equipment can be expensive, leading to higher healthcare costs and subsequently, increased insurance premiums.

3. Aging Population: With the aging population, there is an increased demand for healthcare services. Older individuals often require more frequent medical attention and specialized care. As a result, insurance companies need to account for this demographic shift by adjusting their premiums to meet the rising healthcare needs of the aging population.

4. Government Regulations: Government regulations play a significant role in shaping the health insurance landscape. Changes in legislation, such as the Affordable Care Act, can impact insurance premiums. Insurers must comply with these regulations, which may result in adjustments to their pricing structures.

5. Insurance Provider Costs: Insurance providers incur various costs in administering policies, including customer service, claims processing, and marketing. These costs are factored into the premiums charged to policyholders. As these expenses increase, insurance companies may need to raise premiums to maintain profitability.

Understanding the Impact

It is crucial to understand that the increase in health insurance premiums is not solely the result of one factor but a combination of multiple influences. Insurance companies carefully analyze these factors to determine the appropriate premium rates that balance affordability for policyholders and sustainability for the company.

While the rising cost of health insurance may seem burdensome, it is essential to recognize the value it provides. Health insurance offers financial protection and peace of mind, ensuring that individuals can access necessary medical care without incurring exorbitant out-of-pocket expenses.

Frequently Asked Questions

1. Why do health insurance premiums increase every year?

Health insurance premiums increase due to factors such as medical inflation, advancements in medical technology, the aging population, government regulations, and insurance provider costs.

2. Can I negotiate my health insurance premium?

Typically, health insurance premiums are set by the insurance company and are not negotiable. However, you can explore different insurance providers and policy options to find the best value for your needs.

3. Are there any strategies to lower health insurance premiums?

While you may not have control over all the factors influencing premium rates, you can consider options such as selecting a higher deductible, exploring different insurance providers, or participating in wellness programs offered by your insurer.

4. How often do health insurance premiums increase?

Health insurance premiums can increase annually or at specific intervals determined by the insurance company. It is advisable to review your policy regularly and compare options to ensure you have the most suitable coverage at the best possible price.

5. Do all health insurance plans experience the same premium increases?

No, premium increases can vary depending on factors such as the type of plan, geographic location, age, and health status. It is essential to review and compare different plans to find the most cost-effective option for your specific needs.

6. Are there any government programs that assist with health insurance premiums?

Yes, depending on your eligibility, you may qualify for government programs such as Medicaid or subsidies under the Affordable Care Act, which can help reduce your health insurance premiums.

7. How can I ensure I am getting the best value for my health insurance premium?

To ensure you are getting the best value for your health insurance premium, it is advisable to compare different plans, consider your healthcare needs, and evaluate the coverage and benefits provided by each policy. Additionally, reviewing your policy annually can help you stay informed about any changes in premium rates or coverage.

Remember, understanding the factors influencing health insurance premiums empowers you to make informed decisions and find the most suitable coverage for your needs. Stay proactive and regularly evaluate your options to ensure you have the best possible health insurance plan.

Conclusion

The increase in health insurance premiums can be attributed to various factors, including medical inflation, advancements in medical technology, the aging population, government regulations, and insurance provider costs.

Understanding these influences allows us to appreciate the complexities involved in determining premium rates. Despite the rising costs, health insurance remains a vital investment in safeguarding our well-being.

By staying informed and comparing different insurance options, individuals can make informed decisions to secure the coverage they need at the most reasonable price.

Health Insurance

Navigating Health Insurance Claim Denials: Steps to Increase Approval Chances

How to Deal with Health Insurance Claim Denials

Dealing with health insurance claim denials can be a frustrating and stressful experience. However, it is important to understand that you have options and rights as a policyholder. In this article, we will explore the steps you can take to navigate the appeals process and increase your chances of getting your claim approved.

The first step in dealing with a health insurance claim denial is to carefully review the denial letter. This letter should provide a detailed explanation of why your claim was denied, including any specific policy provisions or exclusions that were cited. It is important to understand the reasoning behind the denial so that you can effectively address it in your appeal.

Once you have reviewed the denial letter, the next step is to gather any supporting documentation that may help strengthen your case. This could include medical records, test results, or any other relevant information that supports the necessity of the treatment or service for which you are seeking coverage. It is important to be thorough in your documentation, as providing as much evidence as possible can greatly increase your chances of a successful appeal.

After gathering your supporting documentation, you will need to draft a formal appeal letter to your insurance company. This letter should be clear, concise, and persuasive, outlining the reasons why you believe your claim should be approved. Be sure to reference any specific policy provisions or exclusions that you believe were misinterpreted or applied incorrectly. It is also helpful to include any relevant medical literature or expert opinions that support your case.

Once you have submitted your appeal, it is important to follow up with your insurance company to ensure that your case is being reviewed in a timely manner. Be persistent but polite, and keep records of all communication with your insurance company, including dates, times, and the names of any representatives you speak with. This will help you stay organized and provide a clear timeline of your efforts to resolve the claim denial.

If your appeal is denied, don’t lose hope. Many insurance companies have multiple levels of appeal, so it may be worth pursuing the next level if you believe you have a strong case. You may also consider seeking assistance from a healthcare advocate or legal professional who specializes in insurance claim denials. They can provide guidance and support throughout the appeals process, increasing your chances of a successful outcome.

In conclusion, dealing with a health insurance claim denial can be a daunting task, but it is important to remember that you have options. By carefully reviewing the denial letter, gathering supporting documentation, and submitting a persuasive appeal, you can increase your chances of getting your claim approved. Don’t be afraid to seek assistance if needed, as there are professionals who can help navigate the appeals process and fight for your rights as a policyholder.

Understanding the Reasons for Claim Denials

Before diving into the appeals process, it is crucial to understand the common reasons why health insurance claims are denied. By familiarizing yourself with these reasons, you can address them effectively in your appeal:

- Lack of pre-authorization: Some medical procedures or treatments require pre-authorization from your insurance provider. If you fail to obtain this prior approval, your claim may be denied. It is important to understand the specific requirements of your insurance policy and ensure that you follow the necessary steps to obtain pre-authorization for any procedures or treatments that require it. This may involve submitting documentation from your healthcare provider, such as medical records or a letter of medical necessity, to support your request for pre-authorization.

- Out-of-network providers: If you receive medical services from a provider who is not in your insurance network, your claim may be denied or only partially covered. It is important to verify the network status of your healthcare providers before receiving treatment to avoid unexpected claim denials. This can typically be done by contacting your insurance company directly or using their online provider directory. If you find yourself in a situation where you need to see an out-of-network provider, you may be able to request a referral or prior authorization from your insurance company to ensure that your claim is processed correctly.

- Medical necessity: Insurance companies may deny claims if they deem the treatment or procedure to be medically unnecessary or experimental. To address this reason for claim denial, it is important to provide thorough documentation from your healthcare provider that clearly outlines the medical necessity of the treatment or procedure. This may include supporting evidence such as test results, medical records, or a letter of medical necessity. It can also be helpful to include any relevant guidelines or recommendations from professional medical associations or governing bodies to strengthen your case.

- Missing information: Incomplete or inaccurate information on your claim form can lead to a denial. Double-check all the details before submitting your claim to ensure that you have provided all the necessary information. This may include your personal information, insurance policy details, healthcare provider information, and a clear description of the services or treatments received. It can be helpful to keep copies of all relevant documentation and correspondence related to your claim to refer back to if any discrepancies arise.

- Expired coverage: If your insurance policy has expired or you failed to pay your premiums, your claim will likely be denied. It is important to keep track of your insurance policy expiration date and ensure that your premiums are paid on time. If you are experiencing financial difficulties and are unable to pay your premiums, it may be worth reaching out to your insurance company to explore options for maintaining coverage or arranging a payment plan.

The Appeals Process

When your health insurance claim gets denied, it is essential to take action promptly. Follow these steps to navigate the appeals process:

1. Review the denial letter

Upon receiving a denial letter from your insurance provider, carefully review it to understand the specific reasons for the denial. This information will help you build a strong case during the appeals process. Look for any discrepancies or errors in the letter that you can address in your appeal.

2. Gather supporting documentation

Collect all relevant medical records, bills, and any other supporting documentation that can help substantiate the necessity of the treatment or procedure. This evidence will strengthen your appeal and increase your chances of success. Make sure to organize the documents in a clear and logical manner, so they are easy to navigate for both yourself and the insurance company.

3. Contact your healthcare provider

Reach out to your healthcare provider and discuss the denial with them. They may be able to provide additional information or documentation to support your appeal. It is crucial to have your healthcare provider on your side during this process, as their expertise and knowledge of your condition can be valuable in strengthening your case.

4. Understand your insurance policy

Take the time to thoroughly read and understand your insurance policy. Familiarize yourself with the coverage limitations, exclusions, and appeal procedures outlined in the policy. This knowledge will empower you when communicating with your insurance provider. It is important to know your rights and what you are entitled to under your policy.

5. Write a compelling appeal letter

Compose a well-crafted appeal letter addressing the specific reasons for the denial. Be concise, clear, and persuasive in explaining why the treatment or procedure is necessary. Include any supporting documentation and medical records that strengthen your case. Consider consulting with a healthcare advocate or a professional writer who specializes in appeals letters to ensure your letter is compelling and effectively conveys your argument.

6. Follow up with your insurance provider

After submitting your appeal letter, follow up with your insurance provider to ensure they received it and to inquire about the status of your appeal. Stay persistent and maintain open lines of communication throughout the process. Keep a record of all your interactions, including dates, times, and the names of the individuals you speak with. This documentation will be valuable if you need to escalate your appeal or seek legal assistance.

7. Seek legal assistance if necessary

If your appeal is still denied, you may want to consider seeking legal assistance. An experienced healthcare attorney can guide you through the next steps, such as filing a complaint with your state’s insurance regulatory agency or pursuing legal action. They can review your case, help you understand your rights, and provide expert advice on the best course of action. While legal assistance should be a last resort, it can be a valuable option if you believe your denial was unjust or if you have exhausted all other avenues.

Remember, navigating the appeals process can be challenging and time-consuming, but it is crucial to advocate for your rights and ensure you receive the healthcare coverage you deserve. Stay organized, be persistent, and seek assistance when needed to increase your chances of a successful appeal.

Frequently Asked Questions

1. Can I appeal a health insurance claim denial more than once?

Yes, in most cases, you have the right to appeal a denial multiple times. Each appeal provides an opportunity to present new evidence or arguments supporting your claim. However, it is crucial to carefully review the appeal process outlined by your insurance provider.

2. How long does the appeals process typically take?

The length of the appeals process can vary depending on your insurance provider and the complexity of your case. In some instances, you may receive a decision within a few weeks, while others may take several months. Stay patient and persistent throughout the process.

3. Can I seek assistance from a patient advocate?

Yes, patient advocates can be valuable resources during the appeals process. They can help you navigate the complexities of healthcare systems, understand your rights, and provide guidance on building a strong appeal.

4. Are there any time limits for filing an appeal?

Yes, insurance providers typically have specific deadlines for filing appeals. It is essential to review your denial letter or insurance policy to determine the exact timeframe for submitting your appeal. Missing the deadline could result in your appeal being automatically denied.

5. Can I hire a medical billing advocate to assist with my appeal?

Yes, a medical billing advocate can help you navigate the intricacies of the healthcare billing system and ensure that your claim is accurately processed. They can review your medical bills, negotiate with providers, and assist with the appeals process.

6. What are my options if my appeal is still denied?

If your appeal is denied, you may have additional options, such as filing a complaint with your state’s insurance regulatory agency or pursuing legal action. Consulting with a healthcare attorney can provide valuable guidance on the next steps to take.

7. Can I prevent claim denials in the future?

While it is impossible to guarantee that all claims will be approved, there are steps you can take to minimize the chances of denial. These include ensuring pre-authorization when required, seeking in-network providers, and carefully reviewing and submitting accurate claim information.

It is important to note that even if you follow all the necessary steps and provide all the required documentation, there is still a possibility that your claim may be denied. Insurance companies have their own criteria for approving or denying claims, and sometimes it may be difficult to understand their reasoning. In such cases, seeking assistance from a patient advocate or a healthcare attorney can be beneficial.

Additionally, it is crucial to keep track of all your medical bills, insurance policies, and correspondence with your insurance provider. This documentation can be useful in case of an appeal or any future disputes. Make sure to keep copies of all relevant documents and maintain a record of all communications.

Remember, the appeals process can be complex and time-consuming, but it is an essential step in advocating for your rights as a policyholder. Stay informed, be persistent, and seek assistance when needed.

Health Insurance

The Importance of Health Insurance Portability

The Importance of Health Insurance Portability

Health insurance portability allows individuals to transfer their existing health insurance policy to a new insurer or plan without losing the benefits and coverage they have already accumulated.

It provides a seamless transition from one insurance provider to another, ensuring that individuals can continue to avail themselves of the necessary healthcare services without any interruption or loss of benefits.

One of the key advantages of health insurance portability is the ability to retain the waiting period benefits. When individuals switch their health insurance plans, they usually have to go through a waiting period before certain pre-existing conditions or specific treatments are covered.

However, with portability, individuals can carry forward the waiting period benefits they have already served, reducing the waiting time for coverage.

Moreover, health insurance portability allows individuals to maintain their continuity of coverage. It ensures that individuals do not have to start from scratch with a new insurance policy, which often involves fulfilling new waiting periods and exclusions.

By transferring their existing policy, individuals can continue to enjoy the benefits and coverage they had with their previous insurer.

Another significant advantage of health insurance portability is the flexibility it offers in terms of network providers. Different insurance providers have tie-ups with specific hospitals and healthcare facilities.

When individuals switch their insurance plans, they may have to change their network of providers, which can be inconvenient, especially if they have established relationships with specific doctors or hospitals.

However, with portability, individuals can choose a plan that allows them to continue receiving treatment from their preferred network of providers.

Furthermore, health insurance portability promotes competition among insurance providers. When individuals have the option to switch their insurance plans without any hassle, it encourages insurers to offer better coverage options, competitive premiums, and improved customer service.

This competition benefits consumers by providing them with a wide range of choices and ensuring that they receive the best possible value for their money.

In conclusion, health insurance portability is of utmost importance in today’s dynamic world. It allows individuals to maintain their coverage, retain waiting period benefits, choose preferred network providers, and benefit from a competitive insurance market.

By understanding the significance of health insurance portability, individuals can make informed decisions and ensure that they have the best possible health insurance coverage to meet their needs.

Health insurance portability is a crucial aspect of the healthcare system that provides individuals with the flexibility to choose the best insurance plan for their needs without the fear of losing their accumulated benefits.

This concept was introduced to address the concerns of individuals who were dissatisfied with their current insurance provider or wanted to explore better options in the market.

One of the main advantages of health insurance portability is that it empowers individuals to take control of their healthcare decisions. It allows them to evaluate different insurance providers based on factors such as coverage, cost, network of healthcare providers, and customer service.

This flexibility ensures that individuals can make informed choices that align with their specific healthcare needs and preferences.

Moreover, health insurance portability promotes healthy competition among insurance providers. When individuals have the freedom to switch insurance plans, it encourages insurance companies to offer more competitive and comprehensive coverage options.

This competition fosters innovation and drives insurance providers to constantly improve their services to attract and retain customers.

Another significant benefit of health insurance portability is the continuity of coverage it offers. When individuals switch from one insurance plan to another, they can seamlessly transfer their existing benefits and coverage without any interruption.

This ensures that individuals do not experience any gaps in their healthcare protection, which is especially crucial for individuals with pre-existing conditions or those who require ongoing medical treatment.

Furthermore, health insurance portability promotes transparency and accountability within the insurance industry. Insurance providers are required to clearly communicate the terms and conditions of their policies, including information on portability, to policyholders.

This transparency enables individuals to make well-informed decisions and hold insurance companies accountable for the services they provide.

In conclusion, health insurance portability is a vital component of the healthcare system that empowers individuals to make informed decisions about their insurance coverage.

It promotes competition among insurance providers, ensures continuity of coverage, and fosters transparency and accountability within the industry.

By offering individuals the freedom to switch insurance plans without losing their accumulated benefits, health insurance portability plays a crucial role in safeguarding the healthcare needs of individuals and their families.

5. Network Access: Another advantage of health insurance portability is the ability to access a wider network of healthcare providers. When individuals switch to a new insurance plan, they may gain access to a larger network of doctors, hospitals, and specialists.

This can be particularly beneficial for individuals who have relocated to a new area or are seeking specialized medical care.

6. Improved Customer Service: Health insurance portability often comes with improved customer service and support. Insurance companies understand the importance of retaining customers and providing a seamless transition process.

Therefore, they strive to offer better assistance, faster claim processing, and more personalized support to individuals who choose to switch their insurance plans.

7. Portability Across Employers: Health insurance portability not only allows individuals to switch between insurance providers but also provides the flexibility to change employers without losing coverage.

This is especially valuable for individuals who frequently change jobs or work in industries with high turnover rates. They can maintain their health insurance coverage even when transitioning to a new employer.

8. Transparency and Ease of Comparison: With health insurance portability, individuals have the opportunity to compare different insurance plans side by side.

This promotes transparency in terms of coverage, premiums, deductibles, and other important factors. It allows individuals to make informed decisions based on their specific needs and budget.

9. Simplified Documentation: When individuals switch their health insurance plans through portability, they do not have to go through the hassle of submitting extensive documentation and medical records again.

The process is simplified, with minimal paperwork required. This saves time and effort for individuals, making the transition smoother and more convenient.

10. Portability for Family Members: Health insurance portability extends beyond individual coverage and can also benefit family members. If an individual switches their insurance plan, their dependents can also be included in the portability process.

This ensures that the entire family can continue to receive uninterrupted coverage and access to healthcare services.

In conclusion, health insurance portability offers numerous benefits to individuals seeking to switch their insurance plans. From continuity of coverage and flexibility in choice to cost savings and enhanced coverage, portability provides individuals with the opportunity to tailor their healthcare protection to their specific needs.

How Does Health Insurance Portability Work?

Health insurance portability involves a simple and systematic process to ensure a smooth transition from one insurance plan to another.

Here are the key steps involved:

- Evaluation of Existing Policy: The first step is to assess your current health insurance policy and understand its coverage, benefits, and limitations. This evaluation is crucial as it helps you determine whether your current policy meets your healthcare needs or if you need to switch to a different plan.

- Research and Comparison: Once you have evaluated your existing policy, it is important to conduct thorough research and compare different insurance providers, their plans, and the additional benefits they offer. This step allows you to make an informed decision and choose a plan that best suits your requirements.

- Application and Documentation: After selecting a suitable insurance plan, the next step is to submit an application for portability. This application typically requires you to provide certain documents, such as previous policy details and medical history. The insurance provider needs this information to assess your eligibility for portability and to determine the premium you will be charged.

- Underwriting and Approval: Once you have submitted the application and necessary documents, the new insurance provider will evaluate your application. This evaluation involves a process called underwriting, where the insurance company assesses the risk involved in providing you with coverage. They will review your medical history, pre-existing conditions, and other relevant factors to determine whether to approve your application.

- Policy Transfer: Upon approval, the existing policy will be transferred to the new insurance provider, ensuring continuity of coverage and benefits. The new insurance provider will issue a new policy document that outlines the terms and conditions of your coverage. It is important to carefully review this document to ensure that all the details are accurate and meet your expectations.

Overall, health insurance portability offers individuals the flexibility to switch to a different insurance plan without losing their existing coverage. By following these steps, you can seamlessly transfer your policy to a new provider and continue enjoying the benefits of health insurance.

8. How long does the health insurance portability process take?

The duration of the health insurance portability process can vary depending on various factors. Typically, it takes around 15 to 30 days for the entire process to be completed.

However, it is important to note that this timeline can be influenced by factors such as the responsiveness of the insurance providers involved and the accuracy and completeness of the documentation provided.

During the portability process, the new insurance provider will review the documents submitted by the policyholder and assess their eligibility for porting the policy.

They will also evaluate the policyholder’s medical history and claims record to determine the premium and coverage options available.

Once all the necessary assessments are completed, the new insurance provider will communicate their decision to the policyholder.

It is advisable for policyholders to initiate the portability process well in advance of the renewal date of their existing policy to allow sufficient time for the completion of all the required procedures. This will help ensure a smooth transition from one insurance provider to another without any gaps in coverage.

During the portability process, policyholders are encouraged to maintain regular communication with both their existing and new insurance providers. This will help them stay informed about the progress of the portability process and address any queries or concerns that may arise along the way.

Overall, while the health insurance portability process may require some time and effort, it offers policyholders the flexibility to switch to an insurance provider that better suits their needs and requirements.

By carefully considering the terms and conditions, coverage options, and premium rates offered by different insurance providers, policyholders can make an informed decision and ensure that their health insurance coverage continues to meet their evolving needs.

Additionally,

It offers advantages such as network access, improved customer service, portability across employers, transparency in plan comparison, simplified documentation, and coverage for family members. With these benefits in mind, individuals can make informed decisions when considering health insurance portability.

Health Insurance

The Importance of Health Insurance in France

The Importance of Health Insurance in France

When it comes to living in France, one of the most important aspects to consider is health insurance. Whether you are a resident or planning to move to France, having the right health insurance coverage is crucial for your well-being and peace of mind. In this article, we will explore the different types of health insurance available in France and help you understand what health insurance you need for a comfortable and worry-free life in this beautiful country.

Understanding the French Healthcare System

Before diving into the specifics of health insurance in France, it’s essential to understand the country’s healthcare system. France has a universal healthcare system, known as the Sécurité Sociale, which provides basic coverage for all residents. This system is funded through social security contributions and taxes.

While the Sécurité Sociale covers a significant portion of medical expenses, it’s important to note that it does not cover everything. This is where private health insurance comes into play, offering additional coverage and benefits.

Types of Health Insurance in France

When considering health insurance options in France, there are two main types to consider:

- Complementary Health Insurance (Mutuelle): This type of insurance is designed to complement the coverage provided by the Sécurité Sociale. It covers additional expenses that are not fully reimbursed by the public system, such as dental care, vision care, and certain medications. Complementary health insurance plans vary in coverage and cost, so it’s important to choose one that suits your specific needs.

- Top-Up Insurance (Assurance Complémentaire): Top-up insurance is an alternative to complementary health insurance. It allows you to choose specific areas of coverage where you want additional protection. This type of insurance is particularly useful for those who already have coverage through their employer or another source but want to enhance their benefits in specific areas.

Choosing the Right Health Insurance for France

Now that you understand the different types of health insurance in France, you may be wondering which one is right for you. Here are a few factors to consider when making your decision:

- Your Health Needs: Assess your current health needs and any pre-existing conditions you may have. This will help you determine the level of coverage you require.

- Your Budget: Consider your budget and how much you can comfortably afford to spend on health insurance premiums. Remember to balance the cost with the level of coverage provided.

- Additional Benefits: Look for additional benefits offered by the insurance provider, such as access to a wide network of healthcare professionals, coverage for alternative therapies, or 24/7 helpline services.

FAQs about Health Insurance in France

Can I use my existing health insurance from another country in France?

It depends on the terms and conditions of your existing insurance policy. Some international health insurance plans provide coverage in multiple countries, including France. However, it’s essential to check with your insurance provider to ensure you have adequate coverage in France.

Is health insurance mandatory in France?

While health insurance is not mandatory for all residents in France, it is highly recommended. Without proper health insurance, you may be responsible for paying the full cost of medical treatments and services.

Can I switch health insurance providers in France?

Yes, you can switch health insurance providers in France. However, it’s important to consider any waiting periods or exclusions that may apply when transferring to a new insurance plan.

Are pre-existing conditions covered by health insurance in France?

Pre-existing conditions are generally covered by health insurance in France. However, there may be waiting periods before you can claim for treatments related to pre-existing conditions. It’s crucial to review the policy details and consult with the insurance provider for specific information.

Can I cancel my health insurance in France?

Yes, you can cancel your health insurance in France. However, it’s important to review the cancellation terms and any potential penalties or consequences before making a decision. It’s advisable to have a new insurance plan in place before canceling your existing coverage.

How do I apply for health insurance in France?

To apply for health insurance in France, you can contact insurance providers directly or work with a licensed insurance broker who can guide you through the process. It’s important to provide accurate information and documentation to ensure a smooth application process.

Can I upgrade my health insurance coverage in France?

Yes, you can upgrade your health insurance coverage in France. If you find that your current plan no longer meets your needs, you can explore options for additional coverage or switch to a more comprehensive plan. It’s advisable to review your insurance needs regularly and make adjustments as necessary.

Conclusion

Having the right health insurance in France is essential for ensuring your well-being and financial security. Whether you choose complementary health insurance or top-up insurance, it’s important to assess your needs, consider your budget, and select a plan that provides the coverage and benefits you require. By understanding the French healthcare system and exploring your options, you can make an informed decision and enjoy peace of mind knowing that you are well-protected in the event of any medical needs.

-

Trending Stories1 year ago

Trending Stories1 year agoCDC: 1 in 4 Americans Still COVID-Free by End of 2022

-

Health5 years ago

Health5 years agoMeghan Trainor Shares Motivational New Song ‘Blink’

-

Health2 years ago

Health2 years agoHow Long Does Monkey Pox Last Before It Surfaces in the Body?

-

Health2 years ago

Health2 years agoWhat Causes Swollen Body? Understanding Edema and its Triggers

-

Health3 years ago

Health3 years agoNutrition and the Importance of a Fitness Program – 3 Things to Know

-

Health3 months ago

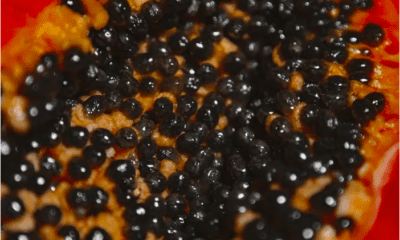

Health3 months agoHow Do Pawpaw Seeds Support Cardiovascular Health?

-

Health3 years ago

Health3 years ago5 Weird Reasons Why Pimples Disappear After Marriage

-

Health2 years ago

Health2 years agoHealth Benefits Of Pawpaw Seed? 7 Things To Know